3.1 Corporate Governance

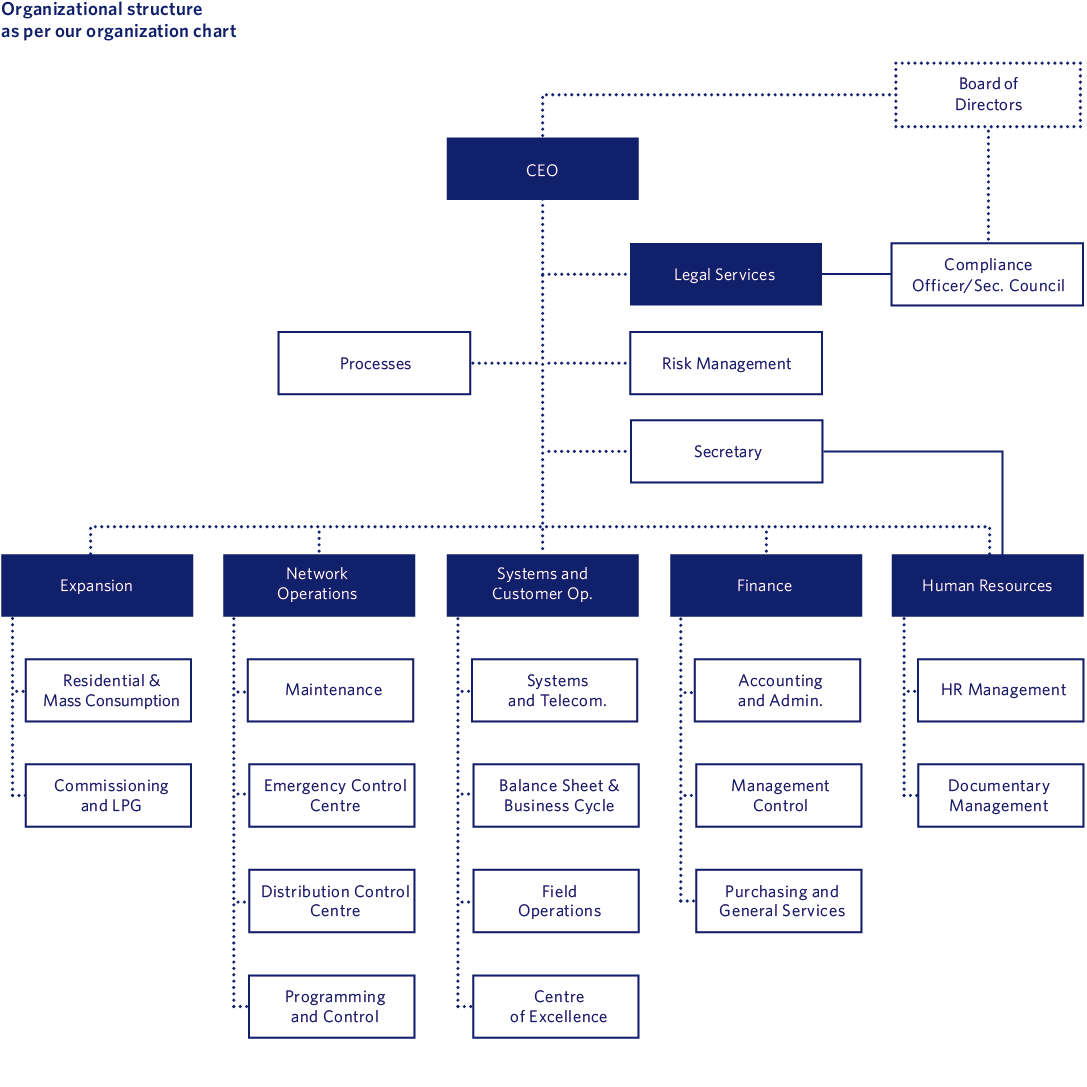

Our structure is revised regularly, and the structure corresponding to the latest review for 2022, performed in Sept. 2022, can be found below. The new structure and name for the departments in the Expansion Division, which align with the company’s strategy, should be noted.

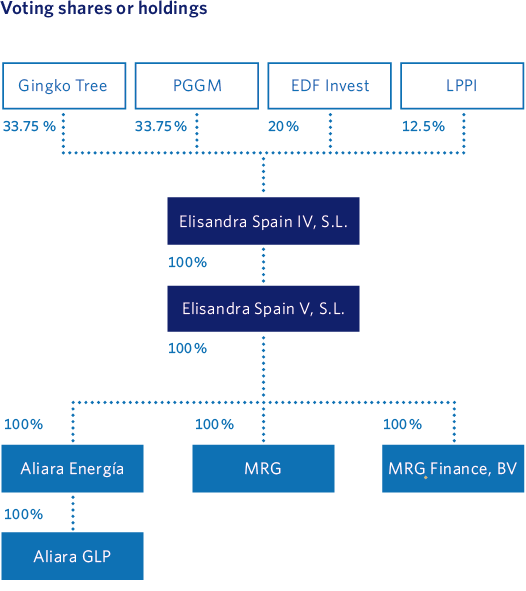

Our sole shareholder is Elisandra Spain V, S.L.U. and its controlling society Elisandra Spain IV, S.L., via which there are four investment groups and business partners with different percentage shareholdings or participations with voting rights: Realgaz, S.A.S (EDF Invest), Stichting Depositary PGGM Infrastructure Funds (PGGM), JCSS Mike S.A.R.L. (Gingko Tree) and LPPI Infrastructure Investments LP (LPPI).

The relational framework with the shareholders is via the shareholders meeting and the Board of Directors, as well as one-on-one meetings, where they can transmit their doubts, interests and needs, and which can also be used as a vehicle to communicate and notify the roll-out of our strategy. They have also been invited to participate in the company’s materiality assessment process, taking on board their opinions and interests. It should be noted that a series of meetings outside of the normal framework were held in 2022, mainly aligned with PGGM’s ESG requirements.

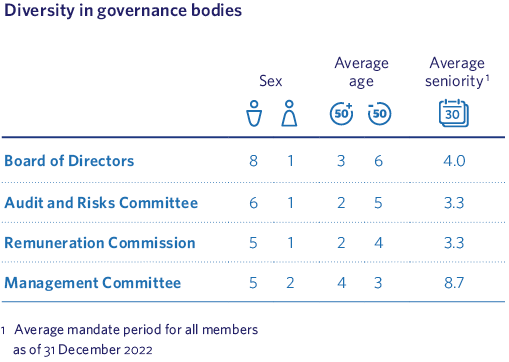

The governance structure comprises the Board of Directors, the Audit and Risks Committee, the Remuneration Committee and the Management Committee. Only the four partners of Elisandra Spain IV, S.L. are represented on these bodies.

When designating our governance bodies, the main criterion is the representation of our shareholders on the majority of these control bodies, thus resulting in a control mechanism and independence when making decisions. Similarly, in line with our code of ethics and our commitment to diversity, we do not discriminate by age, sex, nationality, religion, etc. However, given the history of our company and the gas sector in general, our governance bodies remain largely male-dominated, although this is an aspect that we are working to improve.

This structure is complemented by a series of committees and commissions formed by members of senior management, which provide technical support to our governance responsibilities.

The Board of Directors is the type of administration body established in the articles of association deposited with the Trade Register, and acts jointly. Its individual members are all non-executive proprietary directors, whereas the Management Committee includes executive members.

Currently, and in line with the new sustainability requirements of one of the major shareholders, a process has been initiated to improve members’ training in this regard, incorporating the ESG strategy into the agenda of committee meetings.

The Board of Directors is a collegiate body, therefore there are no significant positions other than the existence of a chairman of the board. Its agreements are implemented by the company’s CEO, who is the only person, together with the Chief Financial Officer and the Finance Department, with general management, administration and decision-making powers. Its operation is governed by the articles of association and the undertakings, rights and obligations established in the Limited Companies Act.

As part of our undertaking to make greater progress in the implementation of best corporate governance practice, and in recognition of the value and importance of a diverse and balanced composition of the Board of Directors, a new female member has been added to said board in 2022, thereby ensuring the existence of appropriate procedures for selecting board members and also achieving balance in the highest levels of the organisation.

Board members are proposed by the Board of Directors itself and their appointment is accepted by the sole shareholder, as set out in law. There are no independent members and they are appointed for 6 years. The average mandate is currently 3.5 years.

The mission, vision and values statements are defined and reviewed by our Management Committee and notified to the Board of Directors for approval

As the highest governance body, the Board of Directors defines the company’s high-level strategies and validates management guidelines, while also monitoring the organisation’s financial and environmental results and employees. The organisation’s processes are, in turn, defined by the company’s Management Committee and any relevant changes are notified to the Board of Directors for approval.

The mission, vision and values statements are defined and reviewed by our Management Committee and notified to the Board of Directors for approval. In addition, the policies, strategies, and objectives related to economic, environmental and social aspects and human rights due diligence are defined by the Management Committee, evaluated by the Audit and Risks Committee and then notified to the Board of Directors for approval as part of management.

Meetings of the Board of Directors are held at least every three months. The preliminary dates and agendas are established in December of each year and approved by the Board to ensure a greater degree of certainty regarding the meetings and minimum contents that will be debated and studied at least one year beforehand.

Starting from this initial agenda, which can be modified depending on specific circumstances and events that may occur, the heads of each division, members of the Management Committee and the different committees operating within the company prepare detailed studies for submission to the Board at each of its meetings, from an environmental, personnel and economic viewpoint. The Board of Directors discusses these topics at its offices and approves the decisions required, if any.

The secretary to the Board is responsible for communications between board members and the Management Committee, channelling all communications and notifications addressed to board members.

Control and evaluation of the financial performance of the highest governance body is undertaken by way of auditing of the annual accounts at the end of the financial year, which, in accordance with Act 11/2018, on non-financial information and diversity, provides non-financial information that can be verified by an independent third party.

The Board of Directors is an unpaid body, as established in the company’s articles of association.

To support the Board, two control bodies, namely the Audit and Risks Committee and the Remuneration Committee, both of which have specific tasks and report directly to the Board, have been established.

The Audit and Risks Committee, which comprises members of the Board of Directors, Management Committee and the head of the Risk Management Dept., monitors corporate risks and identifies, studies and evaluates their impact on the economy, environment and personnel.

Upon proposal from members of the Management Committee, any threat with a potential impact on the economy, environment and personnel may be the subject of a study to determine the probability and magnitude of the impact, and to define the corresponding mitigation plan.

MRG has defined and implemented a process for determining the double-materiality of sustainability-related aspects that involves and promotes participation of the interested parties and during which the perception of the performance of the organisation in each material aspect is compiled. This sustainability report includes the results of that initial study from a double-materiality perspective, as supported by the Board of Directors.

As established in our internal operational regulations, the Audit and Risks Committee reports directly to the Board of Directors and operates in accordance with the provisions of the regulations defining its objectives, functions and composition. Said committee comprises representatives from the Board of Directors of each of the four shareholders, various members of the Management Committee and the Risk Management Department.

The Audit and Risks Committee, which comprises members of the Board of Directors, Management Committee and the head of the Risk Management Dept., monitors corporate risks and identifies, studies and evaluates their impact on the economy, environment and personnel

The contents of the agenda are dealt with at regular committee meetings, which are held prior to each meeting of the Board of Directors, and are agreed on internally at the start of each new financial year.

The Audit and Risks Committee is responsible for supervising and monitoring the processes, submitting financial and non-financial information to the Board of Directors, account auditing, external verification and for the efficacy of the internal risk-control and -management system. The most recurrent tasks include monitoring of the corporate risk map (including operational, technological, regulatory, economic, social, environmental (including those arising due to climate change) cybersecurity and reputational risks), established or proposed mitigation checks and plans, account auditing, auditing of the integrated prevention system, the environment, information quality and security, relevant sustainability-related aspects, the crime-prevention policy and monitoring the compliance system.

The result of these activities allows us to issue recommendations aimed at managing risks and/or for the Board of Directors. We have also continued to monitor the evolution of the risks map post-COVID-19, the case incidence at MRG and contractors versus the number tested per 100,000 persons.

The involvement of shareholders in the salaries of senior executives is via the Remuneration Committee, which comprises the Chairman of the Board and up to four other Board members. The CEO and Head of Human Resources (Secretary) also attend these meetings, except when their own salaries are being discussed.

The CEO is considered to be senior management and their salary is established annually by the Remuneration Committee. Board members are not paid, as established in the company’s articles of association and mentioned previously.

The Remuneration Committee determines and recommends salary policies and any changes to the conditions of service of the CEO, Financial Director and any other Board member designated as being suitable for consideration, or any other employee, to the Board of Directors.

It is responsible for all salary elements for all Departmental Heads at MRG, namely:

- Fixed salary: The amount paid on the basis of the level of responsibility and professional trajectory. It is always paid. Any change is proposed and agreed on annually by the Remuneration Committee.

- Variable salary: The amount awarded on the basis of objectives achieved in a time horizon of one year. These objectives are defined annually by the Remuneration Committee and payment is approved the following year based on the results. The objectives are aligned with the shareholders and the company as a whole (some of the objectives are related to the company’s different sustainability-related aspects).

- Recruitment bonuses or payment of recruitment incentives.

- Remuneration for dismissal: This is the financial payment obtained by the worker if their contract is rescinded and is stated in the contract.

- Pensions: A retirement plan designed to provide a system of social protections that complement those of the public pensions system in the interests of its participants.

The Committee is obliged to agree the principles and structure of the salaries proposed for all members of the Board and Management Committee not subject to a collective bargaining agreement (CBA) and to decide how to attract, retain and develop talent together with the CEO, and to establish succession plans and their revision.

The principles upon which salaries are based are:

- the creation of long-term value

- the attraction, retention and motivation of the best professionals

- to compensate to the level of responsibility and results

- to ensure internal equity and external competitiveness

- to ensure equal salaries for men and women

The remuneration policies for all our employees are in accordance with good corporate governance practice, as established in Article 7 of Act 902/2020, and in that regard we have carried out a salary audit as part of the Equality Plan (2022–2026). The action plan can be found in the Equality Plan Measures section, specifically in the “Salaries” block, and is monitored during follow-up of the plan (see Personnel chapter).

The Remuneration Committee holds at least one or two meetings per year, although this frequency can be increased if required. Proposals from the Committee are submitted to the Board of Directors. Two meetings, covering the following aspects, have been held in 2022:

- Definition and approval of the financial and operational KPIs for variable salaries 2021

- Proposal and approval of salary increases 2022

- Proposal and approval of financial and operational KPIs for variable salaries 2022

The Management Committee is a body comprising the company’s CEO and the heads of the six Unit Divisions. The Unit Divisions are staffed by professionals with extensive experience and skills in our company’s main areas of activity and submit the operational and management proposals they consider to be appropriate or necessary for their respective Units to ensue compliance with the Strategic Plan to the Board. The executive decisions of the Management Committee are adopted by the company’s CEO.

We are fully aware that the acceptance and economic success of the company are only sustainable if it contributes to the outcome of the challenges faced by our society in an active, credible and tangible manner

That person’s main responsibilities are:

- To define the policies, strategies and objectives, which are submitted to the Management Committee, in compliance with the company’s strategic plan, and monitoring thereof.

- The monitoring of overall performance and the specific projects in the company’s operational and business areas: expansion, operations with customers and network operations.

- General supervision of compliance with the financial performance targets.

- The identification of risks and opportunities, evaluating impacts on the economy, the environment and personnel. The definition of risk-mitigation policies and plans, and the monitoring thereof.

- Definition of the performance objectives for processes and supervision of the evolution of the company’s management indicators control panel. The proposal and implementation of improvement actions.

- Monitoring of the various corporate actions with transversal effects considered to be relevant (regulation and legal compliance, sustainability, human resources, health and safety, environment, personal data protection, crime prevention, etc.).

The objectives and operation of the technical committees and commissions identified in this chapter are explained throughout the report, depending on their working area or scope.

3.2 Ethical behaviour

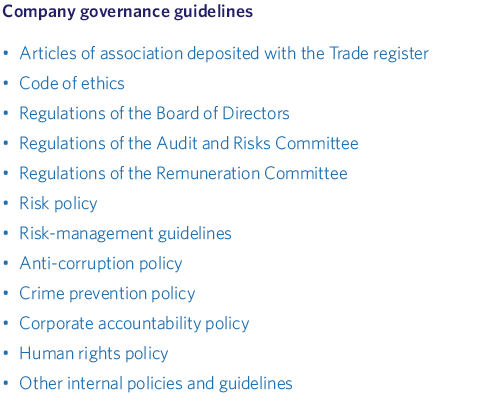

The values of Madrileña Red de Gas include corporate accountability as part of its strategy and positioning, thus ensuring that it forms part of our values. We are fully aware that the acceptance and economic success of the company are only sustainable if it contributes to the outcome of the challenges faced by our society in an active, credible and tangible manner. Thus, the Board at Madrileña Red de Gas establishes good governance criteria for the company and a Code of Ethics and policies that all employees must comply with, as means for achieving these outcomes. All such documents are published periodically and are available on the internet. They also form part of the welcome pack for all new employees.

3.2.1 Human Rights Due Diligence

In line with out values, we have developed a human rights policy as a guiding principle that governs our behaviour and strengthens our undertaking to respect and promote human rights in all our operations, our value chain and all communities in which we are active, paying particular attention to vulnerable groups. This policy forms part of our commitment to sustainable development targets (see Sustainability Strategy chapter).

Our policy is based on the recommendations and rights established in:

- The UN Universal Declaration of Human Rights

- The UN Global Compact

- The UN International Covenant on Economic, Social and Cultural Rights

- The UN International Covenant on Civil and Political Rights

- The fundamental conventions of the International Labour Organization (ILO)

- The UN Convention on the Elimination of All Forms of Discrimination Against Women (CEDAW)

- The UN Guiding Principles on Business and Human Rights

- The UN Convention on the Rights of the Child

- The UN Convention on the Rights of Persons with Disabilities

- The European Directive on corporate due diligence and corporate accountability

- Agenda 2030 for Sustainable Development

This policy is approved by the Management Committee, is applicable to all employees, managers and the Board of Directors, and covers all activities undertaken by our company. Compliance with it is guaranteed by way of corporate accountability policy compliance monitoring and our code of ethics.

In addition, in order to extend the principles of corporate accountability throughout the supply chain, we have extended this undertaking to our suppliers via our Sustainable Purchasing Policy and the Suppliers’ Code of Conduct, as well as by including clauses in all contract relating to working conditions and human rights (see Sustainable Purchasing chapter).

3.2.2 Code of ethics

The aim of our code of ethics is to establish the guidelines that govern the ethical behaviour of all our employees in their day-to-day duties as regards the relationships and interactions they maintain with all stakeholders, in other words employees, customers, suppliers and external collaborators, shareholders, public and private institutions and society in general.

This code of ethics is based on, and complements, Madrileña Red de Gas’ Mission, Vision, Values statement, and is a mode of action to ensure the appropriate behaviour of our employees when carrying out their professional duties.

The code of ethics is applicable to all staff, irrespective of the position they hold and the place where they carry out their duties.

We also promote and encourage the adoption of behavioural guidelines similar to those defined in this code of ethics amongst our suppliers and partner companies. To that end, a Suppliers’ Code of Conduct has been developed.

The Code of Ethics Commission is responsible for ensuring compliance with said code, and its main functions include:

- Promoting the dissemination, awareness and compliance with the code of ethics

- Interpreting the code of ethics and suggesting action in the event of any doubt

- Facilitating the resolution of conflicts related to application of the code of ethics

- Facilitating and managing a communication channel so that all employees, suppliers and partner companies can, in good faith and with no fear of reprisals, consult and notify non-compliance with the code of ethics or any other related information.

- Prepare reports for the governance bodies regarding dissemination and compliance with the code of ethics, as well as the activities of the Commission itself, preparing recommendations or proposals to maintain it up to date, improve its content and facilitate application of any aspects requiring special attention.

- Ensure compliance with the code of ethics and, if applicable, study indications and complaints related to possible infringements thereof.

3.2.3 Complaints channel

Amongst the identification and action checks in situations in which legislative non-compliance and/or practices that go against the values and principles established in the code of ethics and anti-corruption policy may occur, we have implemented an external and independent complaints channel at MRG. This channel guarantees anonymous communication of the complaints submitted by staff or third parties concerning the company contracting the services to the Code of Ethics Commission or other body designated for that purpose. This means that any irregularity or behaviour that goes against the Code of Ethics, anti-corruption policy or current law can be notified with complete confidentiality and no reprisals.

This channel is available on the internet (https://www.canaldedenuncias.com/es/madrilena). It has been available and operational 100% of the time in 2022.

Complaints history

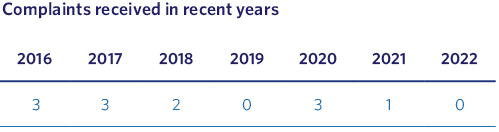

The complaints received via the complaints channel are discussed and studied by the Code of Ethics Commission and distributed to the corresponding area, with the comments agreed, based on their content.

There have been no significant cases of failure to comply with legislation and regulations during the period with which this report is concerned, and no fines have been paid.

In 2022, we erroneously received five complaints related to the normal operation of the company via this channel. None of these were related to the Code of Ethics or the Compliance System.

3.2.4 Prevention of corruption and conflicts of interest

Madrileña Red de Gas has made a firm undertaking to fight against corruption in all its forms and to develop specific practices to prevent it. To that end, we have established an Anti-Corruption Policy. Thus, we reiterate our public undertaking to not interfere in the willingness of persons unrelated to the company to obtain a benefit using unethical practices, and no employee or professional from our company may accept or make direct or indirect payments, gifts or compensations of any type to attempt to influence their commercial, professional or administrative relationship with public or private bodies in an inappropriate manner.

To do so, we have implemented a Compliance System, overseen by the Board of Directors via the Audit and Risks Committee, to help to prevent or mitigate, as far as possible, the risk that any crime, including the crime of corruption, may be committed in our company. No cases of corruption have been detected to date.

If a conflict of interest arises, Board members must inform the Board of Directors and the company itself. This notification is documented and included in the company report. Similarly, as established in the Limited Companies Act, for cases in which a possible future conflict of interest may arise, Article 230 of that legal text establishes the dispensation procedure for special cases which, depending on the case, will be applied by the Board itself or, in this case, by the sole shareholder.

No cases of non-compliance due to penal risks or corruption-related risks have been detected in 2022.

3.3 Compliance

The systematic identification of compliance obligations, analysis of risks and the implications thereof for MRG’s activities, products and services, as regards both compliance with the strategic plan and the minimisation of legal and penal risks underlie the development, implementation and improvement of a solid compliance system and the promotion of a compliance and due diligence culture.

The legal compliance of the Integrated Management System is carried out by way of a standardised process for identifying and evaluating legal requirements supported by an IT system. In addition, compliance checks and measures are established in internal regulations and the risks arising from legal non-compliance are evaluated in all areas of the company.

Moreover, the strong regulatory impulse arising from the energy transition, and the European, national and regional requirements at an environmental, compliance, economic, human rights level, etc., are managed via our risk-management system. (See Risks chapter).

There were no fines or sanctions arising from legal non-compliance in 2022.

3.3.1 Crime-prevention protocol

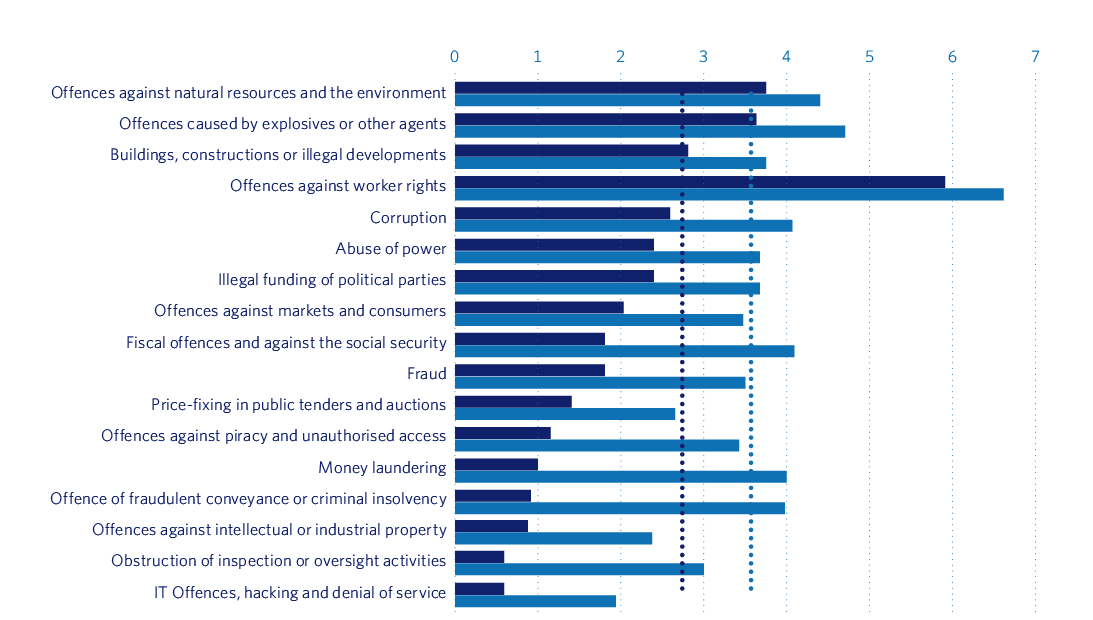

In the framework of the Compliance System, and as a result of the risk analysis at Madrileña Red de Gas, we have defined and distributed internally a Crime-Prevention Protocol covering the most sensitive functional areas and activities in which the crimes to be prevented may be committed. Madrileña Red de Gas undertakes to review this protocol on an on-going basis in light of the analysis and monitoring carried out by the Audit and Risks Committee.

Crime-prevention committee

Madrileña Red de Gas has a Crime-Prevention Committee, comprising the chair of the Board of Directors, the CEO and the compliance officer, with the following goals:

- To review current policies and ensure on-going compliance with new risk-prevention legislation.

- To adapt the checks established to ensure that the risks detected are reduced as far as possible.

- To review the employee-training programs to include new aspects in this field or to refresh them.

This committee studies the actions implemented as part of the crime compliance system, and the action plans proposed by the compliance officer for approval, improvement initiatives to be implemented during the current year and proposals for review of current crime-prevention policies and related training programs are submitted to it. In the event of non-compliance or specific needs, an ad hoc meeting is convened to discuss that aspect and to evaluate it and the proposed solution.

The organisational processes corresponding to the most operational part of the company are, in turn, defined by the company’s Management Committee and are notified to the Board of Directors in the event of any relevant change.

The discussions of the Crime-Prevention Committee are passed to the Audit and Risks Committee, and from there to the Board of Directors, which is informed of all impacts. At its meetings, all the topics discussed by the committees, and any other topics that have arisen, are reported and notified to the Board of Directors. All impacts that may affect the company in any field are managed efficiently using this delegation system. At the annual meeting, the actions implemented as part of the crime compliance system are presented, and the action plans proposed by the compliance officer for approval, improvement initiatives to be implemented during the current year and proposals for review of current crime-prevention policies and related training programs are submitted to it. In the event of non-compliance or specific needs, an ad hoc meeting is convened to discuss that aspect and to evaluate it and the proposed solution.

3.3.2 Commitment, raising awareness and training

Madrileña Red de Gas’s 120 employees (those on partial retirement are not included) receive information regarding the anti-corruption policies and procedures, crime-prevention policy, code of ethics and disciplinary system when implemented.

To determine training needs in the field of crime prevention, the composition of the company’s governance bodies has been taken into account. The Board of Directors and Chairman have created the position of Crime-Compliance Office, to which they delegate these functions, with this body being responsible for approving the crime-prevention and anti-corruption policies, crime-prevention protocol, annual compliance review report and annual action plans with the needs detected, including the role-out, if required, of general and specific crime-prevention training actions, aimed at the company’s executive governance bodies (CEO, heads of area and heads of department), and for all our other employees, as the aim of compliance training is to ensure that all the company’s employees and executive governance bodies comply with their role and position in a manner consistent with the company’s compliance culture and with its commitment to compliance, as per the criteria set out and approved by the Board of Directors.

Madrileña Red de Gas’s 120 employees receive information regarding the anti-corruption policies and procedures, crime-prevention policy, code of ethics and disciplinary system when implemented

- Basic compliance training: basic training in crime prevention provided to all employees irrespective of their professional category and hierarchical level, which is currently given upon joining the company as part of the welcome plan. This course lasts for one hour and is given online, with the efficacy of the training being recorded by passing a questionnaire containing questions on the information acquired. In 2022 this training was given to 10 people (8.3% of the workforce) who were not members of the Management Committee.

- Specific training. In 2022 an external course concerning judicial authorisations was imparted to the Legal Dept.

In addition, penal clauses regarding legal compliance and criminal responsibility are included in all contracts with suppliers and contractors. Legal compliance at all levels, namely work- (occupational health and safety, NI contributions, obligatory training for the activity, etc.) and business-related (compliance with tax responsibilities, accreditation of the activity, etc.) is required in these contracts.

3.3.3 Monitoring and assessment of compliance

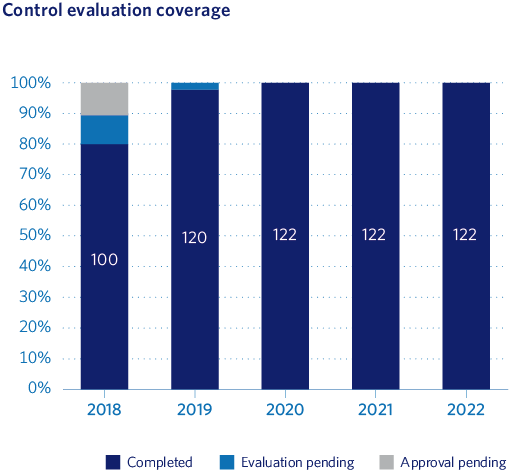

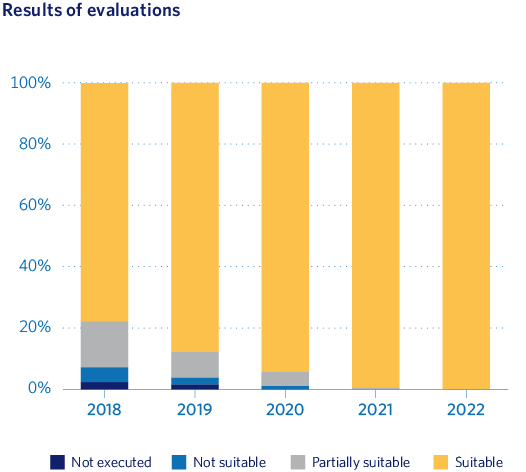

During these activities, the compliance program is monitored and assessed on an on-going basis, thus resulting in a reasonable security level. The control monitoring role has been delegated by Compliance to the persons responsible for executing the controls and the owners thereof.

During 2022, a new assessment of the company’s compliance status has been carried out, analysing the degree of implementation and effectiveness, to analyse and understand the compliance measures implemented and means for controlling, preventing and detecting criminal risks. These control evaluation have been managed via the specific compliance risk management tool, which allows control evaluations to be sent to the executors and owners of said controls.

The following actions have been implemented in 2022 as a result of that evaluation:

- Update of the Risk Matrix and Compliance controls in the section concerning criminal risks and control reviews. The following in particular should be noted:

- With regard to the crime of degrading treatment and the crime of sexual harassment, a new crime that may affect the Company (Organic Law 10 /2022 on the guarantee of sexual freedom), which regulates the duties of prevention and raising awareness in the workplace, imposing a series of obligations on businesspeople, such as promoting working conditions that prevent crimes and any other behaviour against sexual freedom and moral integrity in the workplace from being committed;

It should be noted that, in order to promote an adequate framework of worker protection against occupational hazards associated with potential situations of harassment and violence in the workplace, we already have a specific procedure since March 2013. Our code of ethics prohibits this type of behaviour and the principles and values established therein must be complied with. We have adequately designed the company’s organization, according to the general recommendations for the prevention of psychosocial risks. In addition, we carry out training and information activities regarding psychosocial risk prevention and conflict resolution, especially aimed at team leaders, so that they can recognize and tackle possible conflicts at source. We have not experienced any case of harassment or violence in the workplace in 2022.

- Crimes related to cybersecurity: as a result of the internal audit to obtain ISO 27001 Certification on Information Security (Cybersecurity), specific meetings have been held with the Risk and Cybersecurity department during the first semester of 2022 to share the results and the controls have been improved to mitigate this risk. (See Cybersecurity Risks chapter)

- With regard to the crime of degrading treatment and the crime of sexual harassment, a new crime that may affect the Company (Organic Law 10 /2022 on the guarantee of sexual freedom), which regulates the duties of prevention and raising awareness in the workplace, imposing a series of obligations on businesspeople, such as promoting working conditions that prevent crimes and any other behaviour against sexual freedom and moral integrity in the workplace from being committed;

- A new Compliance training program has also been scheduled for all employees in 2023.

- Updating of the compliance risk tool in order to include the latest updated information in the system.

A comparison of the results mentioned above and those obtained in previous years (2018–2022) shows that there has been a significant improvement in the results of the evaluations. It is important to highlight that the control executors and supervisors have not identified any inadequate or partially adequate controls this year.

- Update of the compliance risk assessment. The Compliance risk assessment related to the crimes included in the Company’s risk map has been updated in order to reflect our current verification risk exposure within the Company for behaviours and conducts that may imply a violation of the corresponding regulations and that may entail liability.

The results of the evaluation process defined the potential risk of infringement, which was updated in the system.

Finally, as a result of the 2021 Action Plan, and executed in 2022, we should highlight the improvement of the controls of computer crimes, hacking and denial of service (cybersecurity), working directly with the executors to make the controls more robust.

3.4 Transparency and communication

As part of our commitment to transparency and accountability, we want to build a framework of trust with our stakeholders, promoting and maximizing the established communication channels, ensuring transparency in relationships, and sharing truthful, adequate, relevant, clear, and useful information, without undermining the integrity of the information given our regulated activity.

In 2022, we have strengthened the communication strategy of the Madrileña Red de Gas website with a new space, the sustainability site (https://madrilena.es/sostenibilidad/) where we share our commitment to sustainability, the Corporate Responsibility policy, our Code of Ethics, and other policies implemented. In addition, concerns about business conduct are answered through our complaints channel.

Additionally, and in line with our commitment to social responsibility, we respond to the interests, needs and expectations of our stakeholders, via their participation in the analysis of relevant aspects and satisfaction surveys, which are carried out systematically with our main stakeholders. In addition, we share our performance, as well as the practice of socially responsible policies, via the publication of financial and non-financial information, as well as sustainability assessments and external ratings by accredited bodies.

Our web site is the first step in our transparency strategy. In particular, we can highlight the investor site, where all relevant information and events regarding the company’s situation are disclosed. And the different digital windows aimed at customers and end users, with the web being an important entry channel (see customer Orientation chapter).

In addition, our communication channels and spaces for dialogue with our stakeholders are spaces where they can raise complaints, advice and concerns regarding our business conduct and the impact of our activities, such as indicating the approach and dialogue with the communities to improve social licence, the call centre and the virtual office, or the complaints channel for any legal breach.

It should be noted that the press room website is a powerful communication and dissemination tool, where in addition to responding to the needs and expectations of the media, we share news related to the company’s situation, the energy transition, relevant initiatives that respond to our strategic plan, recommendations for our customers, etc.

As part of our communication strategy, and responding to new digital mechanisms, significant activity is maintained on social networks: Linkedin, Facebook, WhatsApp groups, etc.

3.5 Integration of ESG criteria into the business strategy

We are fully aware of the effects of climate change and the energy transition on our current business and in the near future, as well as the impact our activity has on the economy, the environment and on people. As such, we not include these elements in our management systems and also integrate them as a transversal element in our strategy. Our commitment to sustainability has been materialized in a clear commitment to the business strategy, promoting sustainable development in the medium and long term, mitigating risks and promoting the creation of value for our stakeholders through the development of a responsible activity.

We have integrated environmental, social and good governance criteria into our strategy, taking into account the geopolitical, economic, technological and regulatory context, the energy transition and climate change. A clear example of this is our NetZero strategy, our drive towards renewable gases and measures taken regarding climate change, our commitment to responsible purchasing and our commitment to due diligence, ESG risk integration and other strategies that are presented throughout this report.

Consequently, the path to integrate sustainability into corporate governance and business decision-making has already begun. The Board of Directors supervises and approves decisions and progress relating to sustainability, currently delegating executive functions to the Audit and Risks Committee. During its meetings, the results of the period presented by the Management Committee are analysed in order to monitor and define the strategies, the progress of activities, relevant issues for the company, the risks and opportunities deriving from the impacts on the economy, the environment and people, and, at the request of the members, detailed information is provided on all those issues that are considered relevant.

Moreover, sustainability-related challenges and commitments are monitored by the Audit and Risks Committee, reporting on the progress made, as well as proposing improvements to the Board of Directors for formal approval, if necessary.

It should be noted that, during 2022, one item on the agenda for two of the four meetings held by the Board of Directors was linked to deployment of the sustainability strategy: monitoring of the carbon footprint, monitoring of the implementation of the 27001 system, monitoring of the main ESG actions arising from the implementation of GRI requirements and the UNE_EN ISO 26000 and IQNet SR10 standards, stakeholder management model, materiality analysis, results of the GRESB Sustainability Index, etc.

This strategy has been strengthened in recent years and is bearing fruit, as can be seen from our presence in the internationally recognized GRESB sustainability index. Promoted by the Board of Directors, and articulated through the Audit and Risks Committee, we have obtained recognition for our deployment of the sustainability strategy, our durability over time and our development of a sustainable business model that is capable of creating value shared by all our stakeholders. After the significant progress achieved in 2021, in 2022 we have consolidated our leadership position, positioning ourselves as the second European gas-distribution company in this international benchmark, and the first in Spain.

Another important element of this ESG strategy is the assessment for the following year of the creation of an ESG Committee, integrating ESG criteria into the decision-making of our governance bodies in a more systematic manner. The relevant aspects to monitor in 2023 include: monitoring of the carbon footprint and its alignment with the Net Zero strategy for 2050, analysis of the risks arising due to climate change and the ecological transition and their impact on the sustainability of the company, the result of the sustainability performance evaluation of the GRESB index and monitoring of the actions derived from the new Sustainability Master Plan. These aspects were previously monitored by the Audit and Risks Committee.

The Board of Directors is the highest body for reviewing and approving sustainability-related information, including material issues. The Audit and Risks Committee establishes internal controls to ensure the integrity and credibility of the information published, involving the leaders of each Department.

3.5.1 Monitoring and assessment of compliance

Despite the geopolitical and economic context at a European level due to the war in Ukraine, and its impact on the energy markets, especially in the gas sector, we have reaffirmed our commitment to sustainability by creating sustainable financial instruments.

Thus, the European Union is promoting measures to maintain the agenda against climate change, establishing new international standards in financial matters and powerful financing mechanisms (Next Generation Funds and Green Deal), which incentivise investments in environmentally sustainable activities. As stated in the Sustainable Business chapter, as part of the Strategic Project for the Recovery and Economic Transformation of Renewable Energies, Renewable Hydrogen and Storage (PERTE ERHA), we are participating in the Inspira Madrid Project, which is one of the first lines of aid for the promotion of renewable hydrogen.

In addition, the consortium promoting this project is working on presenting the project for aid from the European Union corresponding to the CEF Transport (Connecting Europe Facility) program, which is aimed at financing infrastructures that promote the development of the Trans-European Transport Network.

Furthermore, during 2022 the markets have helped to demonstrate that companies with the best ESG attributes benefit from access to better financing conditions. For this reason, we have reaffirmed our commitment to sustainability, through our main financial entities, formalizing a loan linked to sustainability performance while seeking to improve the average cost of debt and strengthening our competitive position. The bond finally agreed is linked to the score obtained in the GRESB index and the relative position of the company in the gas sector in the GRESB index, with very positive results to date.

At the moment, sustainable finance represents a low percentage of our financial debt, and work is underway to increase said percentage.

Finally, in this market context, our shareholders, who are investment groups that seek to invest in sustainable and socially responsible companies, take ESG criteria into account when making financing and investment decisions, and require a business response in accordance with their interests and expectations from us.